NEWS FLASH – inCase Sets New Standard in ID/AML

New inCase Feature – Probably the best ID, AML & KYC Check

We are very happy to finally announce a game changer in the legal industry. Our client AML check is one of the most sophisticated on the market and reduces the risk to law firms considerably. It goes further than any other ID/AML product out there.

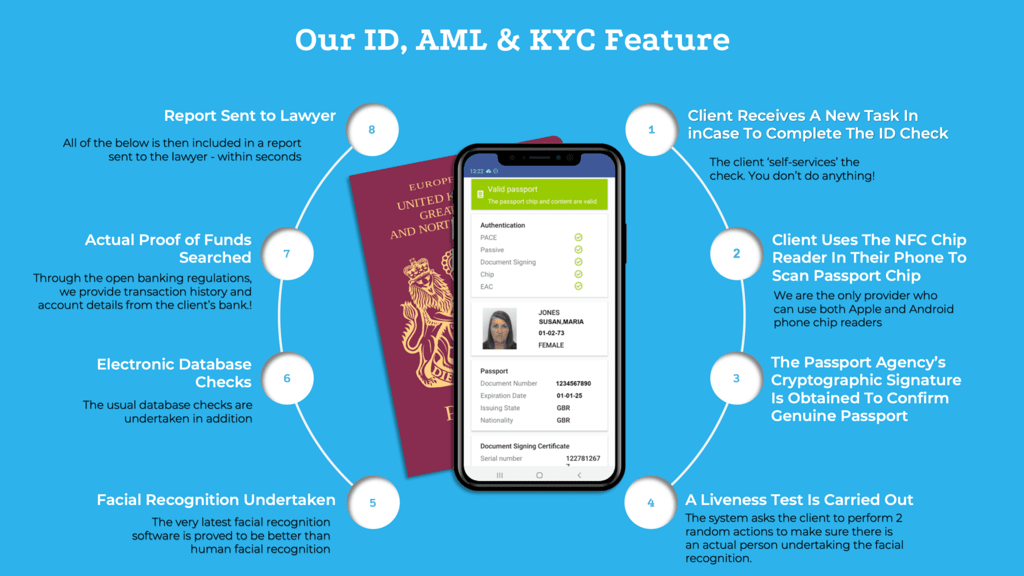

Our ID check uses the client’s phone to read the NFC chip in their passport to confirm that it is a genuine passport and what details are stored on the chip. This chip is cryptographically signed by the issuer and the signature certificate CANNOT be altered. Consequently, it significantly reduces the risk for law firms.

We then use the very latest facial recognition software to compare the live client image with the image on their ID and produce a result that is one of the most accurate ways to confirm photo identification. Facial recognition software has been proven to be more accurate than a human looking at identification*

We also use supplemental document validation software for all pieces of identification that do not have the NFC chip, in order to confirm the accuracy of the document used.

We then undertake the usual database checks and provide a report back to the lawyer, all within a few seconds. The best bit is that it is completely self-service, so the lawyer does nothing apart from sending the ID questionnaire from their Case Management System to the clients app – and this could even be automated. There is no logging onto systems or inputting client details or even anymore integration work to do!

BUT… that’s not all! Included in our ID check is a Proof of Funds check. Which through the open banking regulations, means we can provide you with confirmation from the client’s bank relating to:

- Account details

- Available balance

- Pending payments

- Transactional history of the account

So gone are the days of asking for a bank statement that could be easily doctored. With the client’s permission, you can receive details straight from their bank – again reducing any risk!

To find out more regarding the inCase legal app or our ground-breaking ID, AML & KYC feature, speak to us today!